Friday, 30 June 2017 06:41

How to calculate your internal rate of return using Google Sheets

Written by Jerry H.

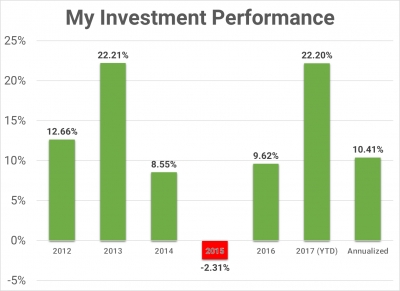

The internal rate of return (IRR) is the dollar-weighted return of a particular investment. It is what I consider to be gold standard measurement of your investment's personal performance. The calculation for IRR looks like a pain in the ass. Luckily, there is a spreadsheet function that calculates this easily for you, and I just so happen to be awesome at creating spreadsheets.

Published in

Investing

Thursday, 29 June 2017 07:41

How diversifying your asset allocation smooths out the ride - a real life example

Written by Jerry H.

I have talked before about diversifying your portfolio by targeting an asset allocation that is right for you. I also recommended a way to balance it across multiple accounts, with the goal of keeping as few funds in each account as you can. When you do this, each account by itself is NOT very diversified, and subject to a relatively large amount of volatility. However, if you take ALL of the accounts together, the overall volatility decreases without much sacrifice in the performance.

Published in

Investing

Wednesday, 28 June 2017 14:37

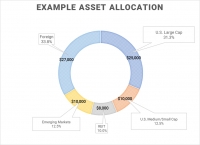

Achieving your target asset allocation across multiple accounts and investment vehicles

Written by Jerry H.

Trying to achieve your target asset allocation across multiple accounts can be quite difficult. It can feel even more so when you consider that each investment vehicle has its own tax consequences. For instance, you may own pre-tax investment accounts, which can include your 401(k), 403(b), individual 401(k), and traditional IRA. You might also own post-tax investment accounts, so called 'Roth' accounts which include the Roth IRA and Roth 401(k) or 403(b) accounts. If all of these are maximized, you may also start placing investments in a taxable brokerage account, like I do. You start accumulating a lot of investment…

Published in

Investing

Tuesday, 27 June 2017 13:13

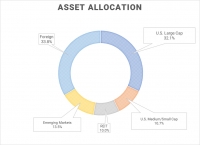

How to choose a target asset allocation for your investments

Written by Jerry H.

When it comes to choosing asset classes in your investment portfolio, most of us know that diversification leads to a better return vs risk profile by reducing volatility without sacrificing returns. That is the premise of investing in index funds instead of picking individual stocks. However, even among different index funds, depending on the asset class they represent, there can be high volatility as well (think emerging market or small cap funds). Thus, it is also important to diversify across different asset classes. I will show you my own personal asset allocation and how I decided on it.

Published in

Investing

Sunday, 11 June 2017 16:16

My attempt to max out my 403(b) retirement account in the first (half) year of residency

Written by Jerry H.

Prior to starting internship and residency, I knew that I had a shortened time frame of 6 months in which to contribute to my 403(b)/401(k), since I would only start earning a salary around July 1 of that year. I also knew that residency would likely be the only time in my career that I would be able to contribute to a Roth IRA (other than the backdoor Roth IRA that I later learned about) and so I definitely wanted to max that out as well. The only problem with such lofty goals is where the money would come from.…

Published in

Investing

Page 3 of 3