Displaying items by tag: asset allocation

Introducing the Beginner Investor Educational Series

I will be creating a free educational series to teach YOU about the basics of investing your money and how to get started no matter if you have an initial investment of $1,000, $10,000, or more. The topics will be relevant to everybody who has just started working or is in the prime of their working lives. I may give specific examples that may be more relevant to Delayed Earners such as physicians.

How much money do you need to retire?

Gone are the days when people work until they turn 65, collect a pension, and retire. Employees used to be able to rely on their employer to take care of them so long as they spent a significant part of their working lives with that employer. Well, that rarely exists these days. Individuals can only rely on themselves to save and invest for their retirement.

Guide to Rebalancing Your Portfolio

Rebalancing a portfolio is essential to maintaining the risk profile that you originally set for your portfolio, and can actually improve the performance of a portfolio compared to if you never rebalanced at all. This article discusses what it means to rebalance a portfolio, why you should do it, and how to do it.

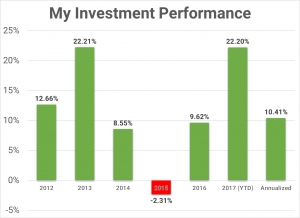

How diversifying your asset allocation smooths out the ride - a real life example

I have talked before about diversifying your portfolio by targeting an asset allocation that is right for you. I also recommended a way to balance it across multiple accounts, with the goal of keeping as few funds in each account as you can. When you do this, each account by itself is NOT very diversified, and subject to a relatively large amount of volatility. However, if you take ALL of the accounts together, the overall volatility decreases without much sacrifice in the performance.

How to choose a target asset allocation for your investments

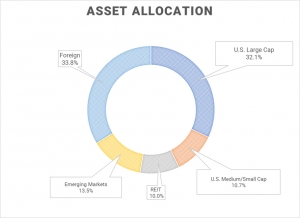

When it comes to choosing asset classes in your investment portfolio, most of us know that diversification leads to a better return vs risk profile by reducing volatility without sacrificing returns. That is the premise of investing in index funds instead of picking individual stocks. However, even among different index funds, depending on the asset class they represent, there can be high volatility as well (think emerging market or small cap funds). Thus, it is also important to diversify across different asset classes. I will show you my own personal asset allocation and how I decided on it.