What Is Dollar Cost Averaging?

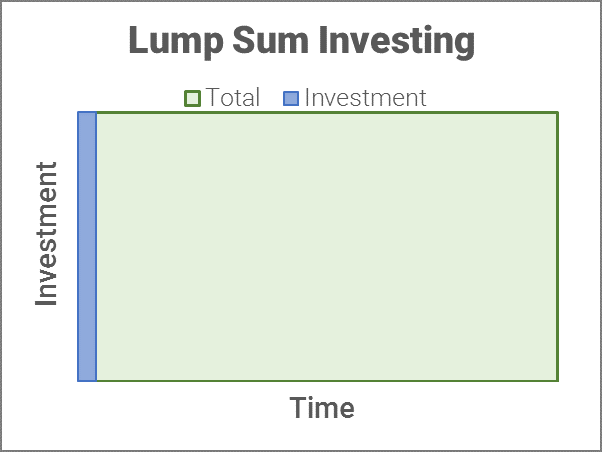

Dollar cost averaging (DCA) is a type of investment strategy where an investor will make constant dollar amount contributions to an investment at regular intervals. This theoretically reduces the risk and smooths out your purchase price over the course of time that you are contributing. The idea is that you are buying more shares of an investment when the price is low, and less shares when the price is high. Below is a visual representation of how the money is invested over time.

This is conceptually the same as automated investing at regular intervals; however, there is one fundamental difference between the two. With DCA, the premise is that you already have all the money to invest at the beginning of the time period, but choose to invest it over time instead of in a lump sum. With automated investing, the thought is that you are getting paid at regular intervals, and you are automating your investments based on receiving those paychecks at that time interval. You only have the money available to invest as you get paid. See the difference? If you already have a lump sum of money available to invest, is it better to invest it all at once, as seen in the graph below? We shall see.

Using IRA Contributions as an Example

The IRA contribution is a perfect example to illustrate whether DCA is effective. For this purpose, it doesn't matter which type of IRA we are talking about. Lets say you are less than 50 years old and the annual contribution limit is $5,500. You already have $5,500 saved up by January 1, 2017, and are deciding whether to invest it all at once at the beginning of the year, or dollar cost average it over the entire year at weekly intervals. Your weekly investment would be $5,500/52 = $105.77. This is something I think about (very briefly) at the beginning of each year, and then go with the lump sum investing. Why? Because *see article title*.

Why Does DCA Generally Do Worse Than Lump Sum Investing?

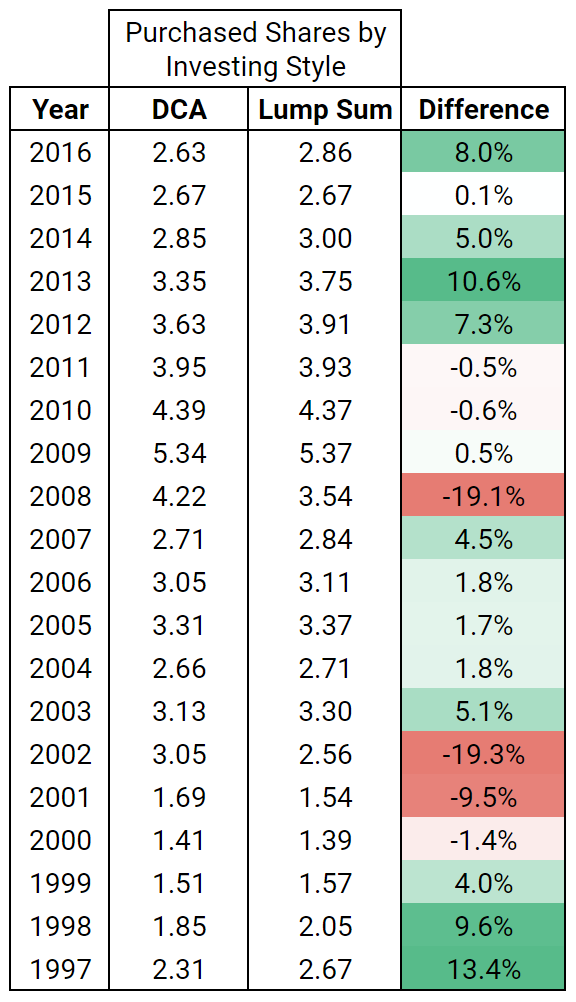

The short answer is that the stock market has a natural tendency to climb higher. Let me show you the difference between DCA and Lump Sum investing over the past twenty years.

The chart above shows the total amount of shares you would have bought of the S&P 500 index if you were to max out your IRA in that particular year by buying them as DCA (in weekly equal investments) or as a lump sum investment at the beginning of the year. I calculated the percent difference between the two, where positive (green) indicates that Lump Sum was better than DCA, and negative (red) means DCA was better than Lump Sum investing. You actually cannot buy the S&P 500 index itself*, but you can track the price of the index with the ticker symbol .INX on Google Finance or ^GSPC on Yahoo Finance.

*You can't buy the S&P 500 index itself, but you can buy an index fund that matches it, such as Vanguard's VFIAX. The reason I did not use it for my calculations is that it did not exist for all of the past twenty years.

What the chart does not include are dividend yields, especially if they are reinvested with a dividend reinvestment plan (DRIP). The average dividend yield of the S&P 500 has been approximately 2%. You of course need to own the investment in order to receive dividends, for which the lump sum investor would qualify for the entire year. The DCA investor would only receive a fraction of this. Thus, in this chart when you see a difference that is between zero and -1%, the performance possibly favors Lump Sum anyways.

Taking it all together, Lump Sum investing will win the majority of the time, because the stock market has a natural tendency to continue growing. The ONLY scenario in which DCA does better than Lump Sum investing is if the market is relatively high when you invest your lump sum, and then the investment stays below that point during the majority of the time period that you are considering. This happened during the years of 2001, 2002, and 2008. In these three years, the stock market performed extremely poorly. Lets look at what happened in 2001, 2002, and 2008.

Obviously if you could predict the occurrence of these crashes, then you would not be Lump Sum investing nor DCA investing. You would not be investing at all until these crises are over. Props to you if this is the case. For the rest of us who are not so clairvoyant, stick to Lump Sum investing.

Other Considerations

- In a taxable account, when you DCA or automate investments using short time intervals (e.g. weekly), then you are less able to take advantage of capital loss harvesting because of having to wait 30 days to avoid a wash sale

- If you are investing through a brokerage that charges commission, then you would be paying a commission each time you make a trade. It would be better to just pay one commission a year instead of fifty-two times a year as you would in this case.

I hope I have shown you the pitfalls of Dollar Cost Averaging and convinced you not do do it. Once again, this is not to detract you from automated investing if your goal is to save as you get paid. Have $5,500 saved up right now to invest? Lump sum invest it into your IRA!