Saturday, 17 June 2017 07:08

Avoiding underpayment penalties for federal taxes - the safe harbor rule

Written by Jerry H.

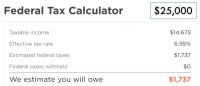

As a proponent of owing federal taxes during filing season as opposed to receiving a refund, I have to be wary to avoid penalties for underpaying taxes along the way. Federal taxes are meant to be a 'pay as you earn' system where you should be "safe harbor" tax law, which are the conditions I need to satisfy in order to NOT owe penalties for underpayment. These can be found in chapter 4 of Publication 505 of the IRS website, which I will describe in more detail in this post.

Published in

Taxes

Tuesday, 13 June 2017 07:14

An argument for owing federal taxes instead of receiving a tax refund

Written by Jerry H.

If given the following options, which would you choose? Would you rather... offer the federal government an interest-free loan for up to 16 months, or receive an interest-free loan from the government for up to 16 months. The heart of this choice is played out every year, when individuals choose their allowances on their W4 form which determines how much taxes to defer for federal taxes. Withhold more than you owe - you will get a tax refund. Withhold less than you owe - you will have to pay the amount owed. Every year when it comes time to file…

Published in

Taxes

Saturday, 10 June 2017 13:39

How should you fill out the W4 form and think about federal taxes when you start your residency?

Written by Jerry H.

From a taxation perspective, starting residency is no different from starting any other salaried employment. What is pretty much a universal truth about residency is that they all start on or around July 1. Anyone who is starting employment in the middle of the calendar year can apply what I discuss below to their situation. I am writing this article because I want to provide a framework for thinking about federal taxes and how to estimate the amount you will owe. The W4 form instructs your employer to automatically withhold a certain amount of money from your paycheck each pay…

Published in

Taxes