Sunday, 11 June 2017 16:16

My attempt to max out my 403(b) retirement account in the first (half) year of residency

Written by Jerry H.

Prior to starting internship and residency, I knew that I had a shortened time frame of 6 months in which to contribute to my 403(b)/401(k), since I would only start earning a salary around July 1 of that year. I also knew that residency would likely be the only time in my career that I would be able to contribute to a Roth IRA (other than the backdoor Roth IRA that I later learned about) and so I definitely wanted to max that out as well. The only problem with such lofty goals is where the money would come from.…

Published in

Investing

Saturday, 10 June 2017 13:39

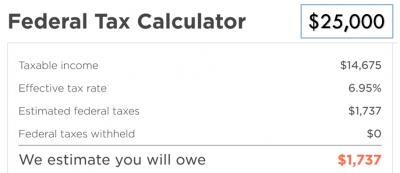

How should you fill out the W4 form and think about federal taxes when you start your residency?

Written by Jerry H.

From a taxation perspective, starting residency is no different from starting any other salaried employment. What is pretty much a universal truth about residency is that they all start on or around July 1. Anyone who is starting employment in the middle of the calendar year can apply what I discuss below to their situation. I am writing this article because I want to provide a framework for thinking about federal taxes and how to estimate the amount you will owe. The W4 form instructs your employer to automatically withhold a certain amount of money from your paycheck each pay…

Published in

Taxes

Page 4 of 4